SUMMARY

Every 16 seconds, a new bank fraud case is reported in Brazil. As more Brazilians rely on mobile banking, messaging apps, and online services, digital scams have exploded—causing huge amounts in financial losses and leaving victims with no recourse. Criminals exploit WhatsApp, Pix, social media, and even AI-generated videos to trick people into sending money or sharing sensitive data. The tactics are constantly evolving: fake job offers, phishing links, fake e-commerce stores, investment fraud, and romance scams are some of the most common schemes. The following sections highlight the most common and emerging scams in Brazil, along with practical guidance on how to stay protected and respond effectively if targeted.

This Content Is Only For Subscribers

To unlock this content, subscribe to INTERLIRA Reports.

A Growing Threat in the Digital Age

In January 2024, a multinational corporation was targeted by a sophisticated scam in Hong Kong, in which a financial employee was deceived into transferring US$25 million to fraudsters. The criminals used AI-generated deepfake videos to create a convincing video call that appeared to include the company’s CFO and several other executives. Although the employee initially suspected that the request received by email was a phishing attempt, he changed his mind after joining the video conference and seeing what he believed were familiar faces and voices. Trusting the apparent legitimacy of the meeting, he authorized multiple transfers. The fraud was only discovered later, when the employee followed up with the company’s headquarters and realized the entire meeting had been fabricated using artificial intelligence.

The rise of digital scams in Brazil reflects a global trend driven by rapid digital transformation.

Social and cultural changes, especially the widespread use of smartphones in daily life, have changed how people interact with the state, financial institutions, and each other. As more aspects of life migrate to digital platforms, especially those accessed via mobile devices, cybercriminals have followed closely behind. This transition to digital life has been accompanied by a worrying surge in cybercrime.

In Brazil, the frequency of these crimes is alarming. The country sees thousands of new financial scam cases every day. Between July 2023 and July 2024, financial losses linked to mobile phone theft and online scams exceeded R$186 billion, according to Datafolha. WhatsApp scams were the most reported in 2023, revealing how criminals exploit messaging apps and social networks to deceive victims.

Face-to-face crimes like robbery—which require physical presence and often involve violence—have become riskier for offenders. Government efforts, coupled with behavioral changes among individuals and companies, such as the increased use of surveillance and security protocols, have made public-space crimes less attractive.

Digital fraud, in contrast, often involves lower risks and lighter legal penalties. Scammers use fake messages, websites, and increasingly, artificial intelligence to clone voices and images. These technologies allow them to impersonate relatives or public figures and request transfers via Pix.

According to ACI Worldwide[1], Pix-related scams alone are expected to increase fivefold by 2028, potentially resulting in losses exceeding R$11 billion.

Statistics and Evolution of Scams in Brazil

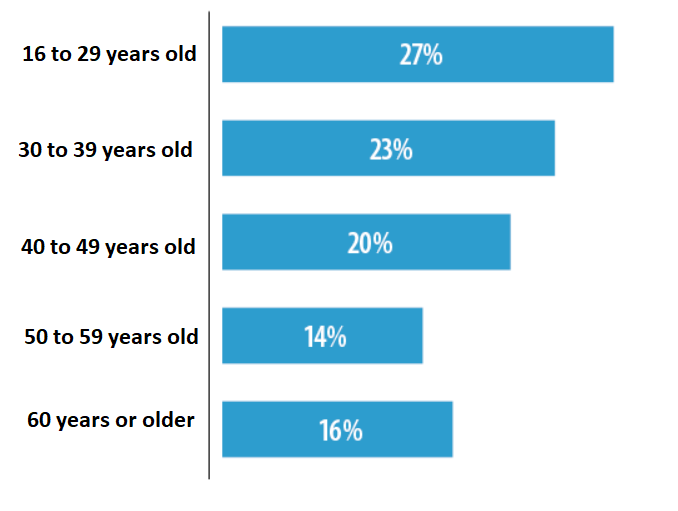

Understanding who falls victim to digital scams is essential for designing effective prevention strategies. Contrary to popular belief, older adults are not the main victims of such crimes in Brazil. A large-scale 2024 survey by DataSenado, which interviewed nearly 22,000 people, revealed that the age group most affected is actually young people between 16 and 29 years old, who account for 27% of reported cases. In comparison, individuals over 60—often perceived as digitally vulnerable—represent 16% of victims.

Elderly individuals are more frequently targeted by traditional fraud schemes, such as card cloning, fake bank representatives, and Pix-related scams, which typically aim to extract sensitive data or convince victims to make unauthorized transfers. Younger people, in contrast, are especially susceptible to fake job offers, fraudulent investment platforms, and deceptive promotions on social media. This vulnerability stems largely from low media literacy and heavy dependence on mobile devices. These patterns reflect a broader transformation in crime, with digital platforms replacing public spaces as the main arena for illicit activity.

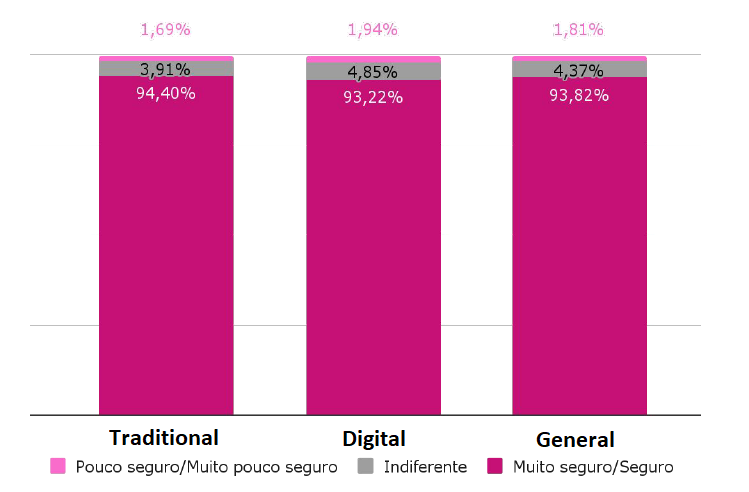

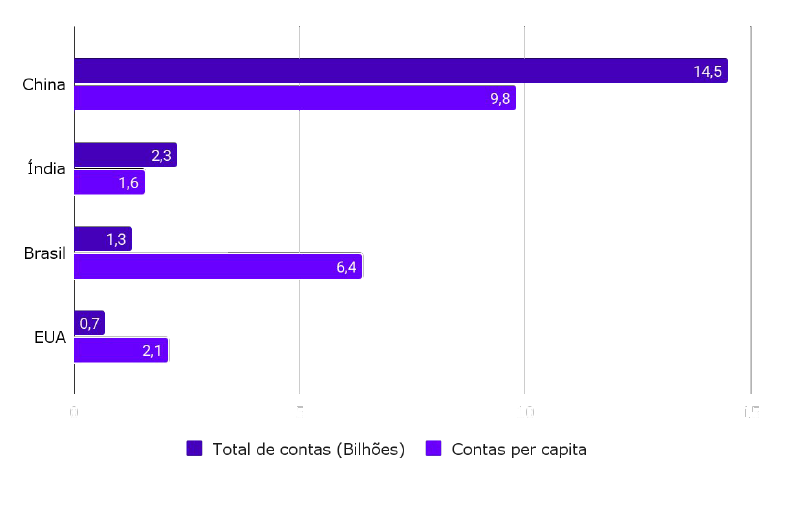

This shift is reinforced by the exponential growth of Brazil’s digital financial ecosystem. With 1.27 billion active bank accounts and nearly 94% of the population banked, Brazil has approximately three times more accounts per capita than the United States. According to Morgan Stanley’s September 2024 report “The End of Growth”, Brazil is also among the countries with the highest penetration of digital payments globally, with around 94% of personal consumption now conducted through digital channels.

The scale of digital fraud is equally staggering. According to the Brazilian Public Security Forum, nearly 8,000 Brazilians fall victim to digital scams every hour—ranging from fake online purchases to unauthorized access to bank accounts following mobile phone thefts.

The frequency of attempted fraud has also become part of daily life: a study by the Global Anti-Scam Alliance found that 94% of Brazilians experienced at least one scam attempt per month in 2024.

Geographically, some regions are more affected than others. The state of São Paulo registered the largest increase in fraud cases, with a 22.7% rise in 2024. Behaviorally, scams are increasingly focused on mobile environments. Data from Febraban revealed that over half a million banking clients were scammed last year, mostly via mobile phones. The most common tactics include WhatsApp account cloning, fake sales, and fraudulent customer service impersonations, often carried out during business hours when victims are more distracted and prone to trust seemingly legitimate contacts.

The Most Common Scams Today

As Brazil becomes increasingly digital, so do the strategies used by scammers. Criminals are constantly adapting their methods to exploit popular platforms, tools, and payment systems, from impersonation on messaging apps to fake bank representatives and advanced AI-generated content. Over time, we have analyzed the most frequent scams affecting Brazilians. Below, there is a summary of the most common schemes currently implemented. For more details, check out our previous articles:

- WhatsApp Scams: WhatsApp, a popular communication app in Brazil, has become a prime target for scams. Tactics include sending fake messages that appear to be from legitimate companies to steal personal information or spread malicious links. Another common scam involves account cloning, where criminals take control of a person’s WhatsApp account and impersonate them to deceive their contacts, often asking for money.

- Fake Bank Call Centers: The fraudster contacts the victim pretending to be an employee of a bank or company. The fraudster then informs them that there are irregularities in the account. From there, the criminal requests personal and financial data and instructs them to make transfers, claiming the need to regularize the problem.

- Phishing Links: These scams involve fake websites or messages designed to look official, often promising discounts or urgent account verifications to trick victims into entering personal or banking information.

- Pix Scams: Pix, a widely used payment method in Brazil, has also become a focus for financial fraud. Scammers exploit Pix’s convenience through several methods: Using fake QR codes to divert payments, spreading false claims of a glitch that doubles transfers, installing apps on victims’ phones to monitor and divert transactions, and others.

- AI-Based Fraud: Using artificial intelligence, scammers clone voices or faces to impersonate family members or public figures. They create fake audio or video messages asking for money or promoting fake investments.

Emerging Scams in Brazil

Beyond these well-established schemes, criminals have begun developing even more creative and deceptive frauds that reflect new consumer habits and digital behaviors. These schemes are becoming more sophisticated, taking advantage of social networks, digital banking, and psychological manipulation to deceive even the most cautious users. Here are some of the most common emerging scams:

- Fake sales scam: Criminals create fake e-commerce websites, send fraudulent promotions via email, SMS, or WhatsApp, and develop fake store profiles on social media to lure victims into making purchases that never arrive. This was the second most common scam in 2024.

- Fake investment scam: Fraudsters build fake companies and professional-looking websites to promote fast and high-return investments. They may initially pay small returns to gain trust, then pressure victims to invest larger sums—before disappearing with the money.

- Loan return scam: Criminals apply for loans using the victim’s data and deposit the funds into the victim’s actual account. They then call pretending to be bank staff and request that the money be returned via Pix or boleto to “cancel” the transaction.

- Fake Delivery Person: This scheme has two main variations. In the first, the person receives a call from someone pretending to be a bank employee, scammers send a courier to collect a “damaged” card after tricking victims into sharing the PIN. Another version involves delivering a “gift” that requires a small payment—but the credit card machine is rigged to overcharge.

- Catfishing scam: On dating apps, criminals pose as attractive people. They try to gain the victim’s trust through their images and then start asking for money.

- Lawyer Scam: It usually starts with undue access to public information about legal proceedings. Criminals pose as lawyers and tell victims they’re entitled to money from a lawsuit—but must first pay a fee via Pix. To receive the amount, the person is told to transfer the equivalent of the income tax via Pix.

How to Protect Yourself

Even with preventive measures, no one is entirely immune to scams. If you become a victim, it is important to act quickly and report the fraud.

Prevention Tips

- Enable two-factor authentication on all messaging and banking apps.

- Be skeptical of prices or promotions that seem too good to be true, especially when they differ significantly from market standards.

- Banks will promptly block suspicious transactions but will never reach out to you to confirm them, much less, contact you to request personal data, passwords, transfers, or security codes. Never share such information.

- Avoid clicking on unknown links. Keep your operating system and antivirus software up to date.

- Be cautious with investment offers promising quick, high returns. Research the company and verify if it is authorized by appropriate financial regulators, such as the Brazilian Securities Commission (CVM).

- Always check website and e-mail domains carefully. Scammers often mimic well-known brand names with small alterations.

- Be wary of unexpected charges outside apps or platforms you used. Double-check the payment amount before using card machines.

- Limit what personal information you share on social media.

- Always verify a person’s identity before making financial transfers.

- Avoid using card machines with defective or unreadable screens. Scammers may tamper with these devices to charge higher amounts or steal your data without your noticing.

If You Fall Victim

- Immediately contact your bank to block transactions.

- File a police report.

- Report the incident through official fraud and consumer protection channels, such as the Brazilian government portal (gov.br).

As digital technology becomes more embedded in daily life, financial scams are no longer isolated incidents; they represent a systemic risk that affects individuals, businesses, and institutions alike. Combating this growing threat requires more than just individual caution: it demands widespread digital literacy, stronger regulations, and coordinated action across sectors. In Brazil’s digital age, security is a shared responsibility, and staying alert is the strongest line of defense.

[1] ACI Worldwide Inc. is a digital payments systems company headquartered in Elkhorn, Omaha, Nebraska, that processes billions of transactions per day, equivalent to trillions of U.S. dollars, for customers in 94 countries.