SUMMARY

The battle for the Brazilian consumer’s meals has become increasingly intense, driven not only by new competitors such as 99Food and Keeta but also by a deeper and more troubling layer of rivalry. Beyond customer acquisition and promotional warfare, the sector now faces escalating threats involving confidential-data leaks, employee solicitation by foreign consultancies, and allegations of industrial espionage. This race to gather strategic intelligence is reshaping the competitive landscape as profoundly as pricing disputes or app-based innovations.

This Content Is Only For Subscribers

To unlock this content, subscribe to INTERLIRA Reports.

While companies plan to invest nearly R$14 billion over the next five years, raising the stakes in a market where delivery already represents a substantial share of restaurant revenue, the scramble for strategic information has emerged as a decisive battleground. Internal investigations, police inquiries, and legal disputes highlight how expansion plans, contract terms, and operational metrics have become highly sought-after assets in the race for market dominance.

Regulatory shifts, particularly The Administrative Council for Economic Defense (Cade)[1]’ 2023 decision limiting exclusivity agreements, have reopened space for competitors and fueled this highly adversarial environment. In this rapidly evolving scenario, competition unfolds simultaneously in courts, digital platforms, and behind-the-scenes intelligence operations, making Brazil’s delivery market one of the most dynamic — and security-sensitive — in the digital economy.

The Delivery Market Landscape

Brazil’s food-delivery market has entered a phase of intense and highly visible competition, where even the thermal backpacks used by delivery drivers have become strategic assets. These bags, emblazoned with the logos of major platforms like iFood, Rappi, 99Food, and the newly arrived Keeta, now function as mobile advertisements circulating across cities. As Keeta launched operations in Santos (SP) in October, the company immediately joined this branding battlefield, distributing its own backpacks to secure street-level visibility.

Delivery drivers report that competitive pressure accelerated as soon as 99Food expanded nationwide. In response, iFood intensified the distribution of branded bags, vouchers, and promotional items, reinforcing its visual dominance. 99Food, on the other hand, has aggressively sought to replace iFood’s bags with its own, signaling a symbolic struggle for brand presence. The dispute reached the courts in October, when the São Paulo Court of Justice (TJ-SP) rejected a 99Food lawsuit accusing iFood of orchestrating a coordinated campaign to suppress its brand in public spaces.

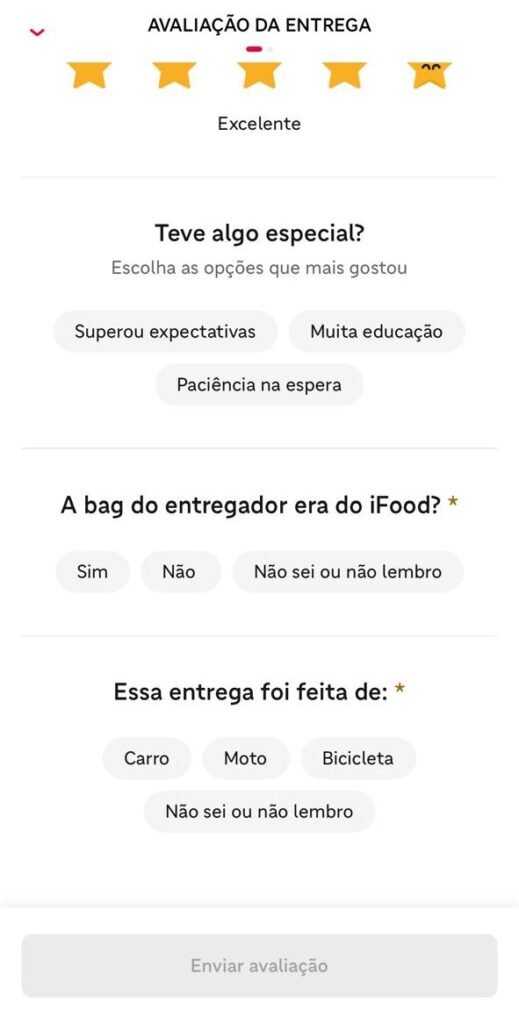

According to labor associations, iFood representatives have visited driver meeting points in various cities, offering fuel vouchers or gifts in exchange for switching to their backpacks. As Luiz Corrêa, president of Sindmobi[2] in Rio de Janeiro, notes, the bag has become “a walking billboard,” with drivers making multiple daily trips across diverse neighborhoods. Platforms have also moved the dispute into the digital environment: since September 2025, iFood has asked customers to identify which brand of backpack their courier was using. Meanwhile, Keeta is betting on innovation, planning to distribute smart helmets equipped with hands-free communication, GPS, and safety sensors.

As companies race to win the loyalty and visibility of delivery workers, the competitive pressure has evolved beyond pricing and promotions. This escalating rivalry lays the groundwork for a more complex and troubling dimension of the delivery war—one where market disputes extend into intelligence gathering, data access, and allegations of industrial espionage.

Industrial Espionage and Data Leaks

As competition intensifies in Brazil’s food-delivery market, a troubling dimension of the rivalry has come to light: allegations of industrial espionage and the theft of confidential data. What once seemed like a traditional corporate dispute has escalated into a series of internal investigations, criminal inquiries, and accusations involving former employees, foreign consultancies, and even stolen equipment.

These incidents highlight how valuable strategic information has become in the battle for market share.

In recent weeks, 99—operator of 99Food—launched an internal probe into a suspected data leak involving stolen corporate laptops and the aggressive solicitation of employees by external consultancies. The compromised material appears to include expansion plans, restaurant contracts, commercial strategies, market share, profit margins, and internal timelines.

According to the company, several employees in strategic roles reported the theft or disappearance of devices containing sensitive information. The pattern bears striking similarities to complaints already filed by iFood, which reported that consultancies approached staff under the guise of conducting “market research.”

These approaches were not isolated. Hundreds of employees from different companies report receiving numerous daily messages offering payments ranging from USD 200 to USD 1,000 in exchange for internal information.

Police investigations have escalated in response. In Piracicaba (SP), authorities executed a search warrant against a former iFood employee who allegedly transferred thousands of internal records—including data from more than 4,000 restaurants—to personal devices.

Another former employee in São Paulo is under investigation for breach of trust and suspect access to the company’s systems.

In several cases, messages, audio clips, and screenshots reveal individuals sharing payment receipts and lists of questions allegedly linked to foreign consultancies, including firms tied to Chinese market research operations. Some questions even referenced the impact of competitors such as Keeta and 99Food, suggesting coordinated intelligence-gathering efforts.

These incidents expose a critical vulnerability: in a sector driven by data, operational insights and strategic planning have become attractive targets. As companies scale rapidly, protecting intellectual property and internal information is no longer optional—it is essential for corporate survival.

Regulatory and Economic Challenges

Beyond espionage and insider threats, Brazil’s delivery-app sector faces a complex regulatory and economic environment that shapes competition and market behavior. The Administrative Council for Economic Defense (Cade) has played a decisive role in this landscape. Its landmark 2023 ruling restricting iFood’s exclusivity agreements with restaurants disrupted long-standing market dynamics and reopened space for competitors. Previously, such agreements had contributed to market concentration so high that global players like Uber Eats, Glovo, and earlier iterations of 99 withdrew from the country. With the end of exclusivity agreements, new entrants, including regional startups, have found opportunities to grow, contributing to a more diverse and competitive ecosystem.

Yet the transition has sparked conflict. In recent months, 99Food and Keeta have contested exclusivity clauses in court and at Cade. Keeta alleges that 99Food engaged in restrictive contracting practices, investing up to R$ 900 million in incentives that allegedly prevented restaurants from joining rival platforms. Regulatory decisions have already produced tangible outcomes: courts have recently prohibited 99Food from enforcing exclusive partnerships in certain regions, reinforcing Cade’s stance on fair competition.

Economic pressures add another layer of complexity. As companies plan nearly R$ 14 billion in investments over the next five years, they compete aggressively for restaurants, couriers, and customers through fee reductions, discount campaigns, and incentive programs. While these practices can benefit consumers through lower prices, they strain profitability and create volatility within the sector. Promotional warfare also raises concerns about sustainability, market fragmentation, and conflicting incentives for workers and restaurants.

Regulators now face the challenge of balancing innovation and consumer welfare with the need to ensure transparency, avoid predatory practices, and foster long-term stability. In this environment, companies must navigate not only market competition but also evolving rules that increasingly shape strategic decisions and limit aggressive expansion tactics.

Strengthening Organizational Defenses

To safeguard sensitive information and reduce exposure to emerging intelligence-gathering threats, companies must adopt a holistic internal governance approach. This begins with implementing access control to information and systems applying the Need-to-know rule, non-disclosure agreements or clauses, protocols for handling confidential data, and compliance procedures. Organizations should maintain full control over corporate devices by enforcing standardized configurations, encrypting stored data, and ensuring systematic backups that preserve operational continuity in case of compromise or loss.

Employee training is the most critical. Staff members should be regularly educated on how to recognize suspicious behaviors, including attempts to extract information through seemingly legitimate “research interviews,” phishing attempts, or informal conversations that probe for operational details. Creating a culture of awareness greatly reduces the likelihood of unintentional leaks.

Broader Implications for the Industry

The battle for dominance in Brazil’s food-delivery market reveals a sector that is no longer defined solely by price competition, logistical efficiency, or brand visibility. Instead, it has evolved into a complex strategic environment where regulatory scrutiny, disputes over exclusivity, and even allegations of industrial espionage shape the competitive landscape. As platforms race to secure restaurants, couriers, and consumers, the true differentiator increasingly lies in how well companies can protect their strategic assets, maintain ethical conduct, and adapt to emerging risks.

In an industry where data, operational insights, and expansion plans have become valuable currency, safeguarding organizational integrity is not merely a defensive measure; it is a strategic imperative. Robust internal governance, employee awareness, careful vetting of external partners, and stronger protection of intellectual property are essential pillars for sustainability and trust. INTERLIRA supports organizations in implementing measures to protect company’s information by offering structured governance frameworks, employee awareness programs, consultant-vetting procedures, and robust intellectual-property protection protocols tailored to each client’s operational reality.

[1] The Administrative Council for Economic Defense (Conselho Administrativo de Defesa Econômica -CADE) is a Brazilian federal agency, linked to the Ministry of Justice and Public Security, and a component of the Brazilian Competition Defense System (SBDC), alongside the Secretariat for Economic Monitoring (SEAE). Its objective is to guide, supervise, prevent, and investigate abuses of economic power, acting in both prevention and repression.

[2] Sindmobi is the Union of Service Providers via Apps and Software for Electronic Devices of Rio de Janeiro and the Metropolitan Region (Sindicato dos Prestadores de Serviços por Meio de Apps e Software para Dispositivos Eletrônicos do Rio de Janeiro e Região Metropolitana).