Online scams have become increasingly common, demanding greater attention to the links and online content we interact with daily. Cybercriminals are constantly creating new methods to deceive people for financial gain, ranging from falsified payment receipts to fake technician impersonations. In Brazil, around 71% of the population has already fallen victim to this type of crime, which shows the need for caution when clicking on links in WhatsApp messages, emails, or SMS, as well as avoiding sharing personal information with strangers. To reduce risks, it is essential to understand how these scams work, recognize their main types, learn what to do if you are targeted, and adopt preventive measures to protect your data and avoid financial losses.

This article is part of a series on digital security. You can read the other texts here.

This Content Is Only For Subscribers

To unlock this content, subscribe to INTERLIRA Reports.

Pix Scams

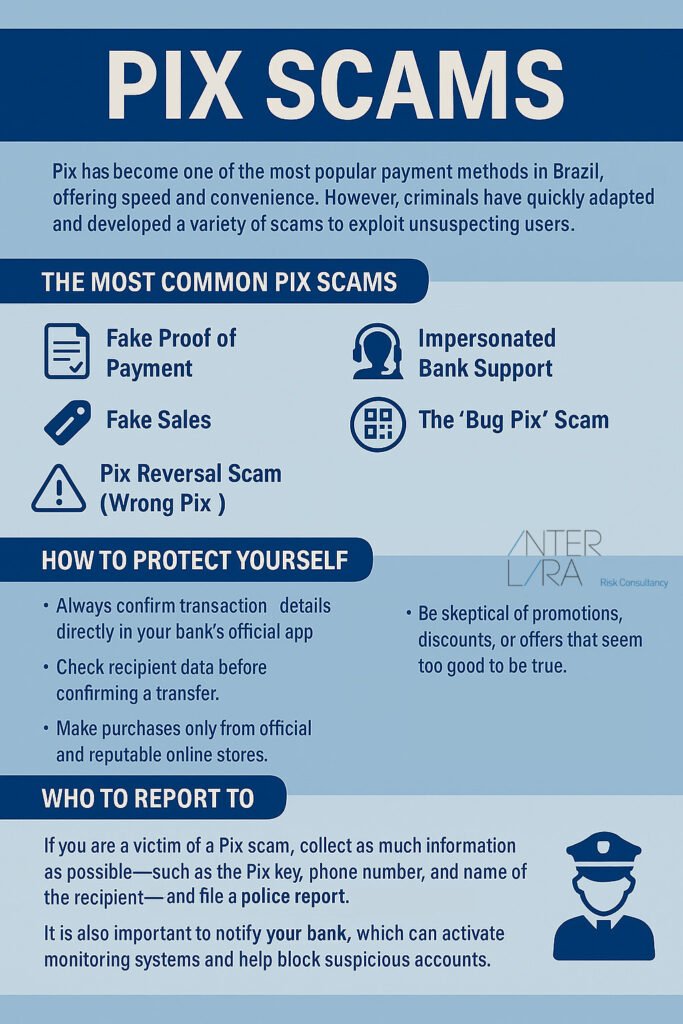

Pix have become one of the most popular payment methods in Brazil, offering speed and convenience. However, criminals have quickly adapted and developed a variety of scams to exploit unsuspecting users. These frauds don’t exploit flaws in Pix itself—since the system is secure with layers of encryption and authentication—but rather use social engineering to manipulate people into lowering their guard.

– The Most Common Pix Scams

• Fake Proof of Payment: Criminals falsify a Pix receipt, showing a lower amount than agreed, and ask the victim to transfer the “missing” difference.

• Fake Sales: Fraudsters advertise products online, request advance payment via Pix, and disappear without delivering the goods.

• Impersonated Bank Support: Scammers pose as bank employees offering “assistance” with setting up a Pix key, when in reality they are stealing personal and financial data.

• Fake QR Codes: Criminals alter videos from real companies or charities, replacing the original QR code with their own to redirect donations or payments.

• The “Bug Pix” Scam: Viral messages on social media claim that a flaw in the system doubles any transfer made to a specific key. Victims send money expecting easy profit, but the scammer simply keeps the funds.

• Pix Reversal Scam (“Wrong Pix”): The fraudster sends money to the victim “by mistake” and asks for it to be returned to a third-party account. Afterward, they use the Central Bank’s Special Return Mechanism to reverse the first transfer, leaving the victim with the loss.

– How to Protect Yourself

• Always confirm transaction details directly in your bank’s official app.

• Check recipient date before confirming a transfer.

• Make purchases only from official and reputable online stores.

• Never accept support or instructions outside your bank’s official service channels.

• If asked to return a Pix by mistake, use only the “Return Transaction” option within your bank’s Pix settings. Never transfer to a third-party account.

• Be skeptical of promotions, discounts, or offers that seem too good to be true.

– Who to Report To

If you are a victim of a Pix scam, collect as much information as possible—such as the Pix key, phone number, and name of the recipient—and file a police report with the Civil Police. It is also important to notify your bank, which can activate monitoring systems and help block suspicious accounts.