Online scams have become increasingly common, demanding greater attention to the links and online content we interact with daily. Cybercriminals are constantly creating new methods to deceive people for financial gain, ranging from falsified payment receipts to fake technician impersonations. In Brazil, around 71% of the population has already fallen victim to this type of crime, which shows the need for caution when clicking on links in WhatsApp messages, emails, or SMS, as well as avoiding sharing personal information with strangers. To reduce risks, it is essential to understand how these scams work, recognize their main types, learn what to do if you are targeted, and adopt preventive measures to protect your data and avoid financial losses.

This article is part of a series on digital security. You can read the other texts here.

This Content Is Only For Subscribers

To unlock this content, subscribe to INTERLIRA Reports.

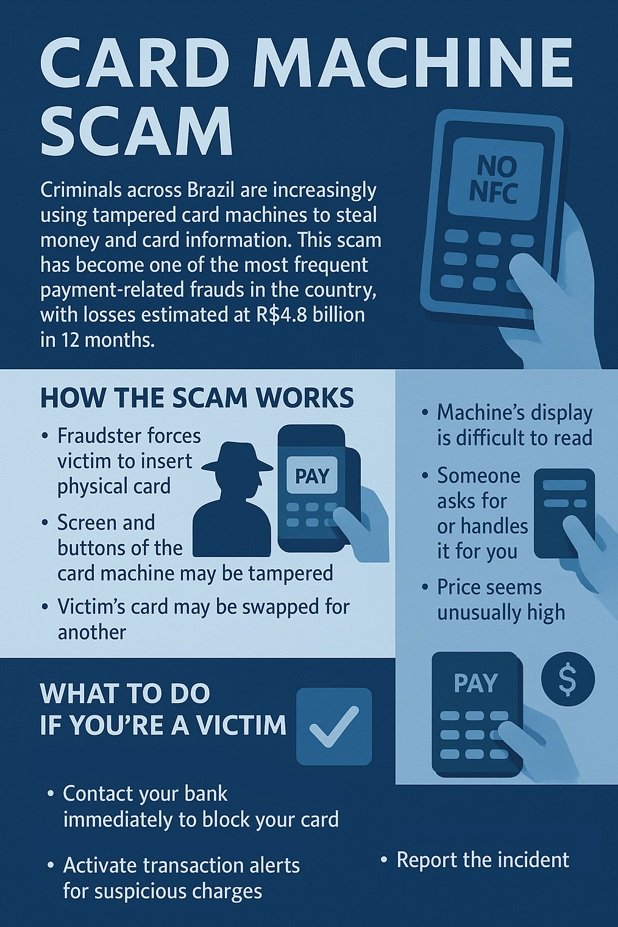

Card Machine Scam

Criminals across Brazil are increasingly using tampered card machines to steal money and card information from unsuspecting customers. This fraud has become one of the most frequent and costly payment-related scams in the country, with losses estimated at R$4.8 billion in just 12 months.

How the Scam Works

Fraudsters, sometimes posing as taxi drivers, delivery workers, or street vendors, present a card machine that they claim can’t process Pix or contactless payments — forcing the victim to insert the physical card. After the card and PIN are captured, criminals sometimes swap the victim’s card for another, leaving the victim unaware they no longer hold their real card. With both the card and PIN, the fraudster can make unauthorized purchases of high value — often long before the victim notices anything is wrong. In some cases, victims only discover the fraud hours later when they receive notifications or check their bank statements.

Types of Cards Tampering Machine

Criminals may use tools or tricks such as:

- A machine screen that is damaged or obstructed so the victim cannot see the transaction amount clearly.

- Hidden buttons that allow scammers to view or record the PIN entered.

- Swapping cards.

Red Flags to Watch For

- A vendor, taxi driver, or other stranger insists the card machine doesn’t accept contactless or Pix payments and pushes you to insert the card.

- The card machine screen is dark, damaged, partially covered, or difficult to read.

- You are distracted while entering your PIN, or the operator takes the card out of your sight.

- The price looks unusually high compared to what you expected or the service provided.

How to Protect Yourself

- Confirm the transaction amount on the machine display before entering your PIN.

- Do not hand your card to someone else — always keep control of your card.

- Prefer payment through official apps or contactless/NFC when possible, as these reduce the need to insert your card.

- Review your transactions regularly via your banking app so you can spot unusual activity early.

What to Do If You’re a Victim

If you notice a transaction you didn’t authorize:

- Contact your bank immediately to block the card and dispute fraudulent charges.

- Activate transaction alerts, so you receive SMS or push notifications for any unauthorized activity.

- Report the incident to the police — a police report can support investigations and help stop repeated fraud attempts.