Online scams have become increasingly common, demanding greater attention to the links and online content we interact with daily. Cybercriminals are constantly creating new methods to deceive people for financial gain, ranging from falsified payment receipts to fake technician impersonations. In Brazil, around 71% of the population has already fallen victim to this type of crime, which shows the need for caution when clicking on links in WhatsApp messages, emails, or SMS, as well as avoiding sharing personal information with strangers. To reduce risks, it is essential to understand how these scams work, recognize their main types, learn what to do if you are targeted, and adopt preventive measures to protect your data and avoid financial losses.

This article is part of a series on digital security. You can read the other texts here.

This Content Is Only For Subscribers

To unlock this content, subscribe to INTERLIRA Reports.

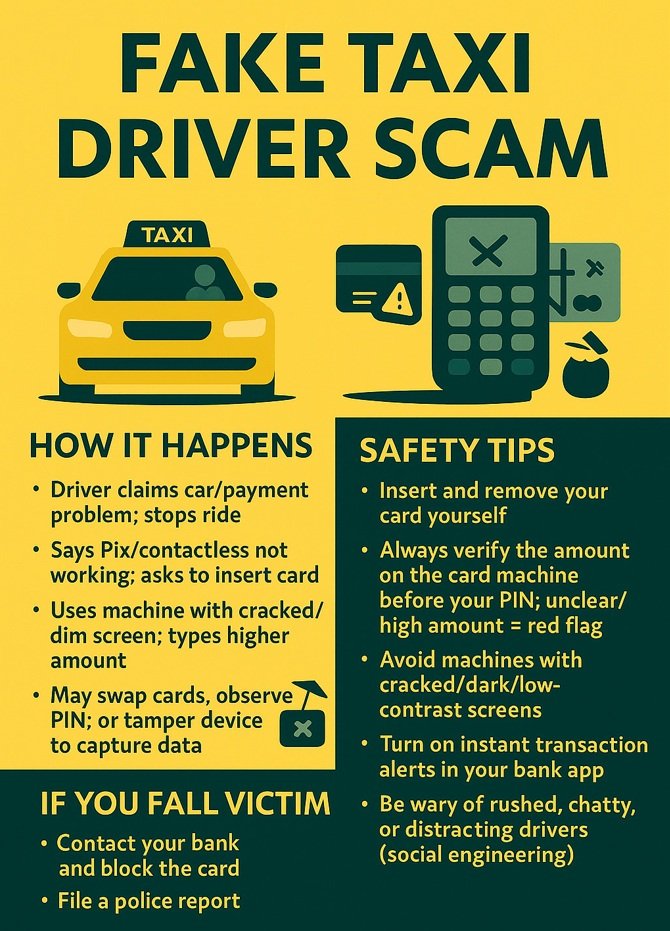

Fake Taxi Driver Scam

You get into a taxi thinking it will be a normal ride, but the ending can feel like a scene from an action movie. The fake taxi scam is sneaky and quick, often leaving passengers overcharged or worse. The driver may claim there is a problem with the car and needs to stop the ride, then he insists that Pix or contactless payments aren’t working and asks you to insert your card into a machine. Some machines have damaged or darkened screens, preventing you from seeing the whole amount typed, and the scammer can charge far more than the agreed fare. In more sophisticated cases, the driver may swap cards, observe your PIN, or tamper with the machine to capture your data. Later, he will use your card and PIN for unauthorized purchases once you leave.

– Safety Tips to Avoid Being Scammed:

• Insert and remove your card yourself.

• Always verify the amount on the machine before entering your PIN. Treat high amounts or unclear displays like a red flag.

• Avoid card machines with cracked, dark, or hard-to-read screens; they may be altered.

• Activate notifications for every transaction in your bank app to detect unauthorized charges immediately.

• Be cautious of drivers who are in a hurry, nervous, or try to distract you—this is “social engineering.”

• Only take taxis from legitimate companies; in Rio de Janeiro, use the official Taxi Rio.

– If You Fall Victim:

• Contact your bank immediately and report the incident.

• File a police report (BO).

• Monitor your account for unusual activity and report any further unauthorized transactions.